For the last two months, the Standard and Poor’s 500 Stock Index was up 14.1% yet you do not read much about that rally in the financial press. At the end of September 2022, the S&P 500 was down 23.9%, clearly in bear market territory. At the end of November 2022, that same index was down 13.1%, increasing nicely over the past two months. Yet, as you and I watch the financial news daily, all we hear is negative financial information based on this so-called upcoming recession that everyone seems to be predicting.

I want to cover some of those facts for you in this posting and some other subjects I find of interest. The U.S. posted another strong employment report on Friday, but the big question is, where have all the workers gone? Particularly, the younger male employees seem to be nowhere in sight in the employment report. I also want to focus on why consumers are accumulating so much cash but are spending their savings to either stay out of work or reduce their working hours. I also want to try to explain the absolute absurdity of the financial press and its emphasis on layoffs; the numbers are meaningless in the grand scheme of things. Also, I want to focus on the increase in GDP that has occurred this year, contrary to any reports you might hear of the economy slowing. Lastly, I must once again take a shot at the traders who are confusing investors with irrelevant information. I want our clients to focus on investing and ignore the hype the traders are publishing in the local press.

|

| Lucy and Harper Wilcox up to a little hocus-pocus in Salem, Massachusetts |

The Dow Jones Industrials Average Stock Index was up 6% for the month of November 2022 and is only down 2.9% for the year 2022. Its 10-year average is 12.9%. In comparison, the Bloomberg Barclays Aggregate Bond Index was up 3.8% for the month of November 2022 but still down 12.5% for the year 2022. Its 10-year average is a measly 1.1% over the last ten years. It pays to note that the bond index is down almost as much as the S&P 500 Stock Index, at 12.5% to 13.1%. It is highly unusual that both stocks and bonds are down in the same year. In fact, this has not happened since 1969.

We had a very strong unemployment report last Friday, with the United States adding 263,000 new jobs. It was surprising to the traders that the unemployment report remained at 3.7%. Going into this quarter there was an assumption by the financial press that due to the higher interest rates, the Federal Reserve has been applying to the economy. Unemployment should be going up. At some point, it will affect jobs causing the unemployment report to go higher. However, during 2022, even though the higher rates of interest has been moving higher, the number of people unemployed has either fallen or stayed stable throughout 2022.

|

| Snowbirds - The Rollins Family headed south for Thanksgiving |

One of the issues the Federal Reserve continues to cite is that if employment is strong, they will have to continue to increase interest rates to slow the economy. However, there is tons of information that will illustrate that employment is not out of control. Today, in the United States, there are 158 million workers currently employed out of a civilian workforce of 164 million. Obviously, the two indicate that there are roughly six million Americans unemployed, which is down from the 6.8 million 2021 average. Basically, the number of unemployed over the last year has been reduced by roughly 800,000 Americans.

|

| Danielle Van Lear and Robby Schultz May your days be merry + bright! |

When interest rates started going up in the spring of 2022, the so-called experts projected that the U.S. would fall into recession in 2022 and the GDP would fall off the chart. As a matter of fact, in September, many of the largest brokerage houses forecasted that there would be another drop off in stocks of 25% before the end of the year. As mentioned above, the S&P rallied 14.1% in October and November 2022, which I guess made their projections somewhat moot.

|

| “Chur!” Martha and Lee Nemeth on a speed boat adventure near Queensland, New Zealand |

Astoundingly, the GDP for the third quarter was recently revised upward to 2.9% by the Commerce Department. This GDP surprised most all viewers of the economy since they were expecting negative not positive numbers. Currently, the Federal Reserve of Atlanta is forecasting GDP growth in the fourth quarter of 2022 to be 2.8%. If we in fact hit that percentage for the year 2022, the entire year will be a positive GDP growth, making the economic picture even more confusing to those looking at it from the outside. When does the recession start, surely not in 2022?

Of course, the financial press says that they were not wrong about GDP growth, it is just delayed until 2023. In fact, due to the strong GDP growth, this would push the Federal Reserve to increase interest rates even higher and longer. However, the evidence would indicate something different as I will illustrate later.

|

| Ken & Una Dooley’s grandkids - “The best gift is the presence of family wrapped in love!” |

In 2019, Amazon had 1.3 million workers. From 2018 to 2019, they increased their workforce by 62%. In 2020, Amazon had 1.6 million workers, which was an increase of 23% year over year. As you can tell, 10,000 workers being laid off is a small percentage of their total workforce and is certainly meaningless. I would bet on a day-to-day basis, based on 1.6 million workers, they probably hire and fire more than 10,000 employees each and every workday.

|

| Eddie and Lucy Wilcox at Harvard - getting an early start on college visits |

I want to remind you that with all this so-called negative news related to employment, there are still 10 million job openings for people to take a job. It has recently been announced that the people laid off, particularly in the retail sectors, had quickly found jobs in other industries that are short employees.

In the most recent unemployment report, something shocking is appearing. Not only are the number of workers in the United States declining due to retirement and other reasons, but the participation by the most productive group in the employment pool, males ages 25 to 54, has dropped from 89.3% to 88.4%, which is a significant number in any one age group. Since this age group is the most qualified in most segments of the economy, it is hard to understand why this group is dropping out of the workforce altogether.

|

| Josh and Ava – Sensei and Grasshopper or Grasshopper and Sensei? |

Take as an example; a recent Federal Reserve report estimated that U.S. households, as of mid-2022, were sitting on $1.7 trillion in excess savings. Make sure you understand that I am not talking about millions, I am talking about trillions of dollars. It is further interesting that during the most recent year, the personal savings rate for Americans had dropped from a high last year during this month at 7.3% to an October low of this year of 2.3%. I think it is pretty clear what you are seeing. So many workers that were in the workforce are now electing to spend their savings rather than go back to work. With the significant reduction in the savings rate, it should be fairly obvious to everyone that these workers no longer need a job because they are spending their savings earned during the pandemic.

|

| Murray and Susan Van Lear rockin’ around the Christmas tree |

If you look at the political football, which is student loan payments, you will note, once again, even though the pandemic is proclaimed over, the payment holiday on those payments has been extended to June 2023. It is assumed by the Federal Reserve that the average savings due to these loan payments being postponed saves an average debtor of roughly $12,800 a year.

|

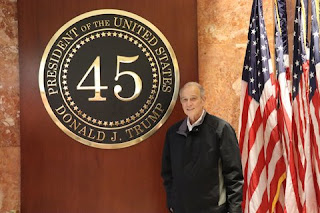

| “Small cheer and great welcome make a merry feast.” - William Shakespeare (not pictured) |

You probably didn’t notice since most people do not actually look at interest rates daily, but long-term interest rates have fallen dramatically for the last several months. Not only has the stock market rallied, but so have the interest rates. Most recently the 10-year treasury was quoted at 4.25% annually, but today that rate has dropped to 3.5% as of this week. That is a huge drop in only a few weeks. What is very interesting about this drop is that clearly interest rates affect long-term mortgages. With this dramatic drop in 10-year treasuries, it is very likely that mortgage rates will fall from 6% to in the 5% area.

|

| Psst, over here! Elon Musk as guest speaker at the Baron Conference |

The decrease in long-term interest rates is important for another reason. The Federal Reserve has pretty good control over short-term rates. They can move rates higher very quickly, which affects short-term interest rates such as the 1, 2 or 3-year treasury bonds. However, they have virtually no control over the long-term rates. So, what you are seeing in the actual world is that while the Federal Reserve continues to push up short-term rates the long-term rates that are affected by the investors are falling.

|

| Caroline Schultz – 8th year in a row on Santa’s nice list! |

The Chairman of the Federal Reserve, Jerome Powell, has already announced that during the December Federal Reserve meeting, the interest rate increase will be 0.5% rather than his customary 0.75%. I think the Federal Reserve is finally seeing, and maybe it is from the pressure of the public, that taking the country into recession would be a mistake for both the Federal Reserve and the country as a whole. I do not believe for a second Federal Chairman Jerome Powell wants to put the country into severe recession. Given the falling interest rates and the clear movement in reduced inflation, it does not look to me that he will be required to do so.

|

| Cecilia Cmeyla and Anam Syed striking a pose at the Omni Hotel |

I guess it has to do with the cycle that we went through in the late 1970s with Federal Chairman Paul Volcker. At the time when Chairman Volcker took over the Federal Reserve inflation rate was 12%, mainly due to the Arab oil embargo against the United States. To bring down inflation, Chairman Volcker immediately forced the country into recession by driving up interest rates to more than 22% and mortgage rates to nearly 17% in the process. Not only did he increase interest rates, but he also restricted the money supply forcing a severe recession in the economy. Unemployment during that time stood at 10% and peaked at 10.8% in 1982.

|

| Reid Schultz showing that he’s strong enough to batten down the hatches! |

My only hope for my clients is that they do not watch too much television related to the financial markets and they do not overreact to things they see on TV. I want to give you an example of how the data is so misinterpreted. Last week all the financial press could talk about was the fact that the Covid-19 shutdown in China was restricting the production of iPhones for Apple products. China is taking a very aggressive approach on Covid-19 protection and has basically shut down many cities for only a few cases. However, one of the major manufacturers of iPhones is in that shutdown area and has had to reduce their working hours because of the Covid-19 restrictions.

|

| Elizabeth Flores and Jose Reyes Ventura. Dream big, shine more, and sparkle bright! |

Yes, it is true that Apple may not be able to meet their production quotas due to their Covid-19 restrictions, but basically so what? They will meet those quotas in the coming weeks and months even though it may not be before Christmas. This event, while it influences the short period of time between now and Christmas, should never have any negative effects on the strength of Apple. Therefore, let the traders sell for the two weeks and buy back, and long-term investors should sit tight.

Once again it brings me to a conundrum that I cannot fully explain. The S&P 500 Index is up 14.1% for the months of October and November 2022 which is good news for long-term investors. It is also fairly clear that the U.S. economy’s GDP has moved higher after being negative for the first two quarters of 2022 and is looking to be positive for the last two quarters of 2022. Also, we know now that the supply constraints are virtually eliminated, and I was recently told that freight rates out of China, which were $53,000 earlier this spring, have now dropped to $1,200 per container. When you see that type of change in the marketplace, you know that whatever constraints there were now have been basically resolved.

|

| It’s a boy!!! Congratulations to Drew and Nicholle Malone! |

While it has been an extraordinarily disappointing year financially, I have great hopes for the future. I think the ridiculous selloff of big tech is going to end soon and you are going to see a massive rally in those stocks that are down 20% to 30% this year. They are the most important companies in America and certainly, nothing that we have seen so far should limit their growth. Therefore, I see this as a major buying opportunity for young people and people that are willing to wait for the stock market to turn back up.

As we go into 2023, I believe we are going to see smaller interest rate increases by the Federal Reserve and if the economy continues as strong as it is today, earnings by major corporations will be higher in 2023 than they were in 2019, further pushing the stock market higher. I know it is frustrating to sit here and watch the stock market go down. But when you have a performance where in the last 20 years, the market has been up 16 times, you have to expect one year to be a negative return. If you have 16 up years and four down years, that is a win rate of 80%.

|

| CiCi sends you holiday joy from the beach in Florida! |

If you have an interest in coming down to visit with us, we look forward to seeing you. We are moving into a slower period for our Firm and will have the time to sit down and review your portfolio, taxes, or anything else you might be interested in.

As always, the foregoing includes my opinions, assumptions, and forecasts. It is perfectly possible that I am wrong.

Best Regards,

Joe Rollins

All investments carry a risk of loss, including the possible loss of principal. There is no assurance that any investment will be profitable.

This commentary contains forward-looking statements, which are provided to allow clients and potential clients the opportunity to understand our beliefs and opinions in respect of the future. These statements are not guarantees, and undue reliance should not be placed on them. Forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual results in future periods to differ materially from our expectations. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements.