From the Desk of Joe Rollins

I sit at home at night and read financial journals and the details regarding the U.S. economy. For a good laugh, I also read the comments on these articles. These comments prove that the public is not very well-informed on what is actually happening in the economy. As all the major headlines scream about the upcoming recession and the effect it would have on the U.S. economy - they are clearly not watching said economy very closely. In this posting, I hope to point out some of the underlying financial details you do not get in the headlines.

|

| 37-year clients, Randy and Kathy Wittman with their two grandchildren |

There is no question that the first six months of 2022 have been a total financial disaster. More than 20 clients have sent me the headline that the first half of 2022 was the worst performance of the S&P since 1970. I guess many of those people did not read the rest of that story. While it is true that the S&P 500 lost 21% in the first half of 1970, the second half saw a gain of 27%. In 2020, the index dropped 4% in the first half yet soared by 21% up in the second half of the year. I don’t believe there is anything about the performance in the first half that will have any effect on the performance in the second half. I will try to give you some facts supporting my conclusion. As I have told clients, I still believe 2022 will be a positive performance year. I know it is hard to be optimistic given the barrage of negative comments, but I think there is a lot of positive in the economy that is not being reported. I will report it.

There is no way to sugarcoat the performance in the first half, and I certainly would not want to mislead anybody regarding how negative the performance was. This is the first time in 50 years that the stock market and government bonds are both down simultaneously. What I do find extraordinarily interesting is that the biggest and most famous mutual funds in the world that are managed by the most experienced and best-known fund managers in the world actually had performance much worse than the S&P 500 Index. The best example is Fidelity Contrafund which manages roughly $90 billion in assets and has the best-known fund manager, maybe of all time, yet still lost 28.2% in the first half. Most growth mutual funds performed much worse than the S&P 500 Index and had losses in the above 30% range. It was an unusual six months for sure. As bad as they are, the bad performance was pretty consistent across all asset classes. It is not like you could have been in one asset class and far outperformed the other since they all had dramatic losses.

|

| Partner Eddie Wilcox, his wife Jennifer and their daughters Lucy (10) and Harper (12) |

The Standard & Poor’s Index of 500 stocks was down 20% for the first half of 2022 and down a scary 16.1% in the second quarter. The NASDAQ Composite Index was down 29.2% for the first six months ended June 30, 2022, and down 22.3% in the second quarter. The Dow Jones Industrial Average was down 14.4% in the first half of 2022 and down 10.8% in the second quarter. If you thought you would get any relief from bonds, the Bloomberg Barclays Aggregate Bond Index was down 10.3% for the first half of 2022 and down 4.7% in the second quarter of 2022. Basically, the above numbers illustrate that there was nowhere to hide during the first six months of 2022, but frankly, that has very little to do with what might happen during the rest of the year.

Almost everything you read in the financial news talks about the upcoming recession, and maybe we are already in recession. The GDP was reported at -1.6% during the first quarter of 2022, and the Federal Reserve of Atlanta is forecasting a decline of 1.2% in the second quarter of 2022. If those numbers are accurate, that will lead to the most common definition of a “technical recession” since it had two consecutive negative GDP reports. However, that is not the technical definition of a recession since recessions are established by much more sophisticated means. It is hard to imagine that the country could actually be in recession when the labor market continues to be outstanding and continues to grow. Just on Friday, the labor numbers were reported with a growth of 372,000 jobs for June 2022. They also reported that the unemployment rate remained unchanged at 3.6%, just like it had been for the four previous months.

One of the things that leads to a strong economy is more people working. We now have more people working than we did before Covid-19 broke out in 2020. It is very difficult to enter a recession with so many job openings. A recession, more than anything else, is a collapse in the labor markets; yet instead of seeing a collapse, we are actually seeing an expansion of these markets.

The numbers are quite convincing when you look at the underlying labor numbers reported on Friday. The continuing claims for unemployment are down 57% year over year. The unemployment rate is down 39% from the same level as one year ago. There are currently 11,254,000 job openings in the most recent report reflected only 5,912,000 total unemployed. Once again, this month, we had more than twice as many job openings as we had unemployed.

|

| Joe and Ava waiting patiently for the 4th of July fireworks |

The not so strange coincidence of this many people working in America is that tax revenue collections by the U.S. government are setting monthly records. Never in the history of the U.S. government have revenue collections been as strong as they are now. Back when the Republicans moved to cut income tax rates in 2016, there was a massive outcry by the Democratic minority that lower interest rates would destroy this economy. I guess once again, it has been positively illustrated that if you cut income tax rates and put people to work, income tax collections will actually go up, not down. I wonder how long it will be before politicians begin to understand this correlation.

What is even more amusing regarding the discussion is that California is proposing to increase the income tax rate for individuals who make more than $2 million to 15.5%. It is amazing that politicians just cannot conceive the benefits of putting more people to work - putting more people to work by cutting income taxes increases revenue, it does not decrease it.

|

| Ava and CiCi at the beach |

There are interesting facts about the economy now that the general media are not reporting. There is a widespread reduction in commodity prices that are affecting virtually all commodities. Maybe the significant decreases are due to the supply chain finally catching up with demand. However, these substantial reductions in commodity pricing will almost assuredly reduce inflation in the future. I will address the gas prices later in this posting, but the evidence is overwhelming that a major reset in commodity prices has taken effect, yet it has not been affected by the inflation rate. Since GDP is a backwards calculation, this is the future.

I remember one time reporting that the availability of lumber and its pricing was a detriment to homebuilders. However, in the last 12 months, the price of lumber has gone from $1,464 to $648, which is a reduction in the price of over 50%. But it is not just lumber that is going down dramatically. Copper is perceived to be one of the indicators of a strong economy, and when copper is high, it usually reflects the future for a positive performance. In recent months copper has dropped over 20%, along with corn prices which are now 30% lower than the May highs, and soybeans and wheat have fallen 16% and 35%, respectively. We all remember the threat of a wheat shortage when the Ukrainian War broke out. Now wheat is being shipped by the invaders of Russia to the markets, and prices have come down rather than gone up. Another interesting one is that steel prices are also down over 50% of their recent highs, but more importantly, even oil is down 18% from its high, and the natural gas price is one-third of where it was during the energy panic.

So, it is not just a few of the commodities that have had a major price reduction; it looks widespread amongst most commodities. One might argue that these commodity prices may have gone down due to this upcoming recession and the lack of demand. I think it has more to do with the supply chain untangling and speculation reducing these commodity prices. There is no question that the economy is slowing, and that is a good thing. However, if commodities continue to decline, we could easily see inflation under control in a relatively short period of time as compared to the years forecasted by the so-called experts. Interestingly, you will also see things like fertilizer, down 34%, and they are a large energy user to produce their product. Prices should start declining. Many can argue that all these items lead to lower inflation numbers. However, we all really know that the rise of inflation is solely due to the increase in oil and energy in the U.S. Virtually all the items listed above are directly affected by higher energy costs. The farmer must use considerable energy to get the crops in, and then the harvests are distributed to the retail stores, who then pass it on at a higher cost in energy. It was The President’s choice and desire to increase the price of gasoline, and now we see the effects causing instability in the markets. The primary reason inflation is high is due to the increase in oil.

|

| Dakota and Ava lighting up fireworks on the 4th of July |

On his first day of office, The President shut down construction on the XL pipeline that brings oil out of Canada. There has been no reduction of oil coming out of Canada since it is now being shipped by truck or train – both of which are much worse for the atmosphere than the pipeline, but he needed to prove a point to his environmental supporters.

In addition, The President shut off all new leases for drilling in the Gulf of Mexico and on Federal land. Therefore, for the last year and a half, there have been little to no new explorations for energy sources in the U.S. Recently courts have overturned those rulings, and the Biden Administration will be forced to begin issuing leases in the Gulf of Mexico and on Federal land. You may recall that as recently as 2016, the U.S. was 100% self-sufficient in energy with production in the United States, Canada, and Mexico. However, if you cut off supply, the price of gasoline goes up. It has doubled in price.

The administration is trying to convince the public that the price of oil went up because of the Ukrainian war and blames the Russians. However, the U.S. buys no oil from Russia; therefore, the prices are a result of the lack of supply being produced in the U.S. However, it is not all gloom and doom. Over the last one-year period, the number of working oil rigs has increased by over 50%. Due to the high prices, there is a massive run-up of people now wanting to produce oil. Assuming a reasonable effort to award these leases on Federal land and the Gulf of Mexico, we could see higher production overall and reduce the price of oil. In an attempt to keep the price of oil down, the President is releasing inventory from the Strategic Petroleum Reserve to put more supply on the market. It is hard to believe that over the weekend oil companies were selling oil to China out of our reserves. It is just hard to understand the decisions made by the government, where we are selling our reserve that is there for national emergencies to a country that is clearly hostile to America in every way.

|

| Reid (6) and Caroline (8) Schultz celebrating their swim team wins |

If you follow the media, you’d think with the so-called upcoming recession and potential job cuts, that the country will basically be waiting in the bread lines before this is all over. It’s almost laughable to think that we would have a contraction of the job market from its now robust rate of 3.6% to greater than 6% needed for a severe recession. However, they continue to report the scary stories; I guess since they just don’t have anything else to report. The facts, however, are extraordinarily different.

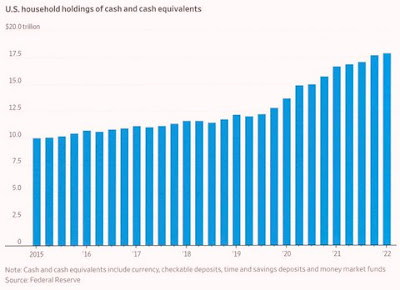

The Federal Reserve recently reported that U.S. households at the end of the 1st quarter of 2022 had $17.9 trillion in cash and cash equivalents in their possession. That’s an unbelievably high number, and it has grown from the $13.7 trillion they had at the end of the 1st quarter of 2020. Therefore, in the two intervening years, U.S households have accumulated roughly $4 trillion in new cash and savings. This is a huge cushion against any potential downturn in the economy. As shown in the graph below, these amounts have been gradually growing each year. However, in most recent years, those numbers have skyrocketed due to the government giving people money during the COVID 19 crisis and people not being able to spend that money. Also, this huge amount will almost assuredly allow U.S. residents to continue to spend at their current levels, notwithstanding economic circumstances. Since this cash and cash equivalents has never been higher, no one knows what these amounts' effects will be. But almost assuredly, they will prevent a prolonged and severe recession.

You might think that individuals are the only ones that are flush with cash at the current time. That would also be a misnomer. At the current time, it is estimated that U.S. corporations hold roughly $4 trillion in cash. This cash can be utilized for share repurchases and acquisitions that would move the markets higher. Never in the history of American finance has the combination of cash being held by corporations and cash/cash equivalents held by individuals been higher. Certainly not indicative of any upcoming financial setback. U.S. Congress and banks have never been as financially sound as today.

This leads us to the question of the day which would be “Who is actually buying stocks at the current time?” Well, it looks like corporations are buying back their own stock at record levels. In the 1st quarter of 2022, there were $281 million of purchases of treasury stock by major corporations. More importantly, over 12 months before that, major corporations bought back $985 billion worth of their own stock. If any individual has potential knowledge of the future of their company, it would be the executives of the companies themselves. They know more about potential earnings sales coming up than the public. The fact that they’re buying stock back at record levels should indicate to you the confidence they have in their financial circumstances. The numbers quoted above were an increase of 97.2% from the previous 12-month period. Clearly, corporate America is extraordinarily bullish on its own stock and is willing to spend close to $1 trillion to buy it back.

Most people do not understand the effect of a company repurchasing its stock. While this transaction does not improve earnings, it significantly reduces the number of shares, therefore increasing the earnings per share of each company. In prior years, it was always assumed that a very successful company would pay large dividends. Corporate America has figured out that if you buy back the stock, you can improve the company's earnings per share, which is much more critical than paying higher dividends. The people that are buying stocks now are the people who understand that the market always recovers over a relatively short period of time. As I have mentioned often in these postings, when I first entered the investment business, the large market selloff in 1987 reduced the DOW from 2,400 to 1,700. It was a sad day on that selloff, and everybody was expressing the opinion that the market would never go higher. In those intervening years, the Dow Industrial Average has gone from that 1,700 level to almost 31,000.

|

| Mia Musciano-Howard’s twins Marti and Mitch (18) with her parents Muzzy (94) and Jennie (89) |

The market always recovers because the U.S. economy continues to grow. You will see people like Warren Buffett who is reported to have spent close to $30 billion on new stock over the last 60 days. That was a particularly active time for him and his company, given that he’s not made significant new stock purchases over the prior 12 months. People understand this is the golden opportunity to buy companies at unprecedented lows. Why it’s always true that the stocks may continue to go down, if you’re a long-term investor you will see them much higher 5, 10, and 20 years down the road. Warren Buffett said, “Be fearful when people are greedy and be greedy when people are fearful.”

I always go back to the famous quotes by Peter Lynch, the famous fund manager at the Fidelity Magellan Fund, for many years. He had an extraordinary run of stock gains because he was always invested at all times. His most famous quote, which should mean a lot to all of us, is as follows. “Long term, the stock market's a very good place to be. But more people have lost money waiting for corrections and anticipating corrections than in the actual corrections. Trying to predict market highs and lows is not productive.” This is very relevant in today’s market.

That is where we find ourselves today. Even though the financial news would like you to believe that there will be a significant reduction in earnings due to the upcoming recession, earnings are projected to go higher in the second quarter than a year ago. Earnings are anticipated to reflect a growth of 5.6% during the second quarter of 2022, even with the economy's slowdown. Currently, the market is valued at 17 times projected 2022 earnings and 16 times the projected 2023 earnings. This historically is lower than the average over time. The market is corrected, and now would be the time to pick up stocks at a very attractive price.

|

| DeNay Gonzales of our client support staff catching a ride in Colorado |

I always find it funny that people clamor to buy when stocks are high and go hide when stocks are low. If you have a long-term horizon, now would be the opportunity to pick up stocks at bargain-basement prices. It is not to say that the market might not continue to go down, but over time ever-lower prices will be rewarded in the future with higher valuations.

As always, the foregoing includes my opinions, assumptions, and forecasts. It is perfectly possible that I am wrong.

Best Regards,

Joe Rollins

All investments carry a risk of loss, including the possible loss of principal. There is no assurance that any investment will be profitable.

This commentary contains forward-looking statements, which are provided to allow clients and potential clients the opportunity to understand our beliefs and opinions in respect of the future. These statements are not guarantees, and undue reliance should not be placed on them. Forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual results in future periods to differ materially from our expectations. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements.